As part of my ongoing blog series about emerging wholesale marketplaces, I’ve been exploring the potential of Faire (formerly Indigo Fair). While there’s certainly a lot to love about working with this wholesale platform for artisans, we don’t often hear much about the disadvantages. I set aside for now my hobby of playing 666casino games, to give you the best information I could have about the inevitable downside of faire. I’ve spent weeks studying this wholesale platform and speaking to retailers and brand owners who have a stake in the marketplace. I’m eager to share what I’ve learned about the disadvantages of Faire so that you can make an informed decision for your business.

Faire executives have agreed to address my concerns, and I look forward to sharing their response in an upcoming blog.

FAIRE CHARGES A HEFTY COMMISSION, ESPECIALLY ON FIRST ORDERS

A significant downside of Faire wholesale is their fee structure, which has evolved over time. The rate for new makers onboarding in early 2019 is 25% on the first order from any buyer. It then becomes 15% on subsequent orders from the same buyer. Faire frequently extends net 60 terms to shopkeepers, and makers can elect to pay an additional 3% fee for immediate payment. You can also choose to wait thirty days for payment and skip the 3% fee.

That translates to a substantial commission of up to 28% on Faire orders. As a consultant who’s had the privilege of coaching hundreds of brands through the mechanics of product pricing, those margins make me cringe. Let’s explore how that breaks down for a product that retails for $30.

DOING THE MATH ON FAIRE COMMISSIONS

Assuming a traditional keystone markup of 100%, a candle that sells for $30 online and in stores will wholesale for $15. I would advise the maker to limit the cost of creation (inclusive of raw materials, packaging, labor, and overhead) to between $5 and $6 so that their $15 wholesale target is 2.5-3x their cost.

When the candle sells for $15, Faire collects a $3.75 (25%) commission, assuming it’s the first time this buyer has purchased the brand. If the maker opts for immediate payment upon shipment, Faire will collect another 3% for a total of $4.20 of each unit sold.

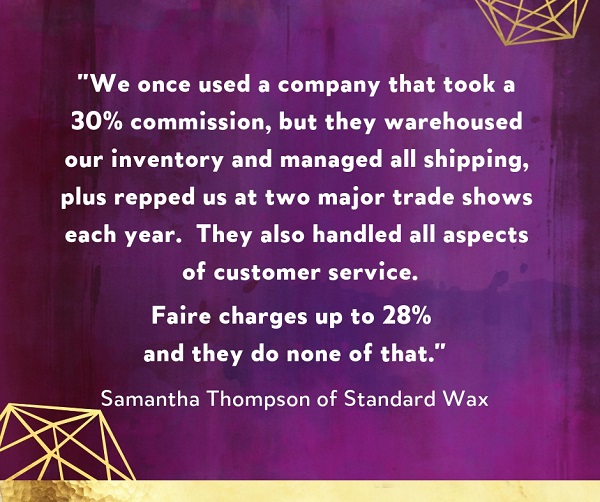

That’s a handsome piece of the pie for Faire and a frighteningly slim margin for the artisan. To be clear: We should all expect to pay marketing expenses. Sales reps typically charge a 15% commission, in addition to the cost of samples and possible showroom fees. A single trade show appearance can easily tally $10,000.

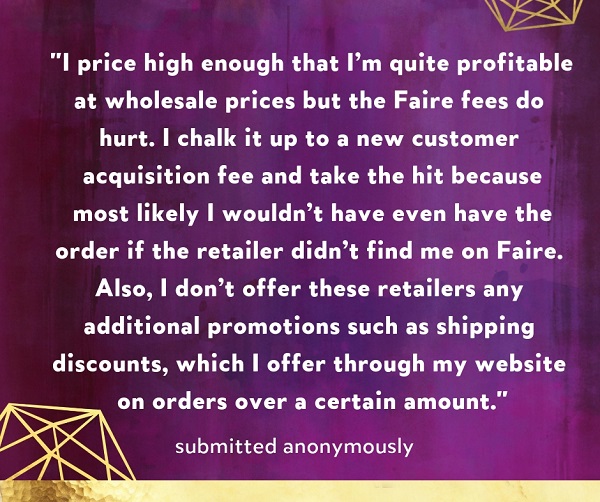

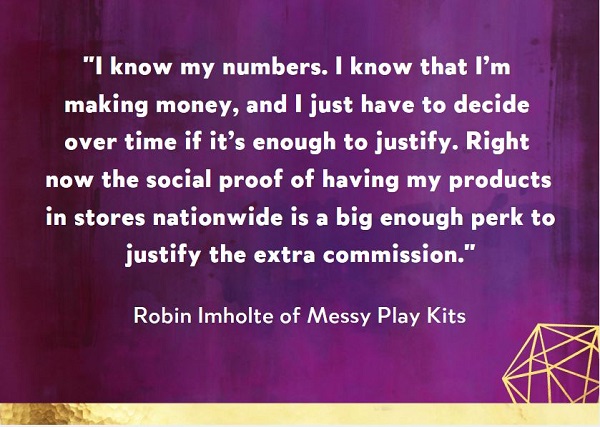

While savvy brand owners bake marketing expenses into their products, they don’t often bake in 28%. And as someone that’s had the opportunity to peek inside the financials of hundreds of maker businesses (jewelers, ceramists, stationers, chandlers, apothecary brands, apparel brands, etc.), I’m keenly aware that a 28% commission isn’t sustainable for the vast majority of Lucky Break clients.

CAN YOU SELL FOR LESS THAN KEYSTONE ON FAIRE?

It’s also worth noting that Faire prohibits inflated wholesale pricing structures on the platform. While you’re allowed to sell at less that keystone (50% of your own retail), those products will be flagged for buyers. In all instances, your wholesale prices on Faire must match your wholesale prices elsewhere.

Faire’s policies make clear that their “Maker Success Team” regular performs pricing and content audits. “We review for wholesale and retail price consistency between your sites and when such discrepancies are identified through our audits or communicated to us from retailers, we may reach out and require action be taken to realign price consistency. Non-response and/or continued discrepancies may ultimately result in the temporary or permanent suspension of your account.”

Makers who joined the platform early enjoy a lower commission structure on Faire, often as low as 15%. Commission structures have been a bit all over the place, evolving as Faire fine-tunes its models and scales in proportion to the venture capital pouring into their effort. I have no information from Faire about whether they’ll be honoring the original commission structures indefinitely. However, they’re certainly honoring them at the moment.

FAIRE INCENTIVIZES FIRST ORDERS, RESULTING IN HIGHER COMMISSIONS

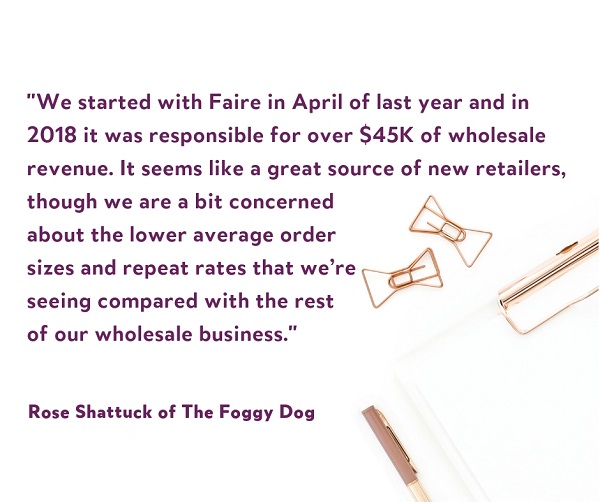

Another downside of Faire is that buyers are continually encouraged to “brand hop,” which results in higher commissions for Faire and less loyalty to brand owners. The first time a retailer buys from a specific brand, they enjoy net 60 terms, free shipping, and free returns on unsold merchandise. The majority of those benefits evaporate on second and subsequent orders from the same brand.

While perpetually being fed new brands and compelling order incentives is a buyer’s dream, it’s problematic for brand owners. When the majority of orders delivered to Faire brands are from first-time buyers, brands are operating in the 25-28% commission zone more frequently than the 15-18% commission range. That’s painfully expensive.

The fact that brand profiles on Faire automatically suggest a curated selection of competitive brands doesn’t exactly inspire loyalty among shopkeepers. While discovering your brand, the marketplace feeds shopkeepers other options for purchase from within the same product category. Inserting those “other brands” into the conversation when a buyer returns to your Faire page to place a reorder doesn’t bode well for the original brand of interest.

FAIRE “OWNS” THE BUYER + CONTROLS THE COMMUNICATION

At its core, Faire is a connector- a matchmaking service between brands and buyers that facilitates discovery. Naturally, it’s in the best interest of Faire to continue managing that relationship to reap the benefit of a commission. The nature of the relationship between retailers, brand owners, and Faire has some interesting implications.

According to the Faire guidelines, brand owners must keep first (and subsequent) transactions on the platform. Additionally, brands may not contact shops directly. They’re directed to utilize Faire’s messenger system to facilitate communication with retailers. That system enables conversations with buyers without revealing their contact information.

Interestingly, some brand owners can actually see the email addresses associated with their orders. I recently spoke with Julia Gold of Whispering Willow, an early adopter of the Faire platform and a moderator for the unofficial Facebook group for Faire makers. “We have full access to buyer’s email addresses and phone numbers. Some people seem to have access to this information while others do not. There are other programs (for example, the ability to invoice buyers directly) that others have access to and we do not. Some of these programs are in beta and have only released to small groups.”

Because Faire is ever-evolving, I’m not sure whether the display of buyer contact information is a beta program or if Faire previously displayed the contacts and then phased out that feature over time.

FAIRE IS THE KEEPER OF A STARTLING AMOUNT OF POWER

Regardless, it’s clear that Faire sits in the power position. They establish the parameters around the flow of communication and maintain the power to influence decision making. Faire controls which brands can play in their sandbox, which brands display for any given retailer, and how those brands transact. In a nutshell: Faire owns the buyers, not the brand.

None of that is surprising, but it’s an essential piece of the puzzle that I’ve noticed is often overlooked. Thanks to the simplified onboarding process and the sizable audience that they’ve accumulated in a short period, Faire has quickly become an easy avenue for additional revenue among the maker community.

But I’m always a bit hesitant about becoming dependent on any one platform. I coach the small businesses that I work with to be aware of their vulnerabilities and build plan B’s whenever possible. What I’ve found is that consolidations of power are rarely beneficial in the long term, and short-term gains often come back to bite. I’ve borne witness to these sorts of symbiotic relationships thanks to artisan’s dependence on Etsy, Etsy Wholesale, and Amazon. Most of my clients who have put the majority of their eggs in those baskets have been disappointed by either the results, the imbalance of power, or both.

A key component of Faire’s pitch to investors was their aim to become the Amazon of wholesale, and that brings the inevitable comparison. What will Faire’s next steps look like now that they have $116 million of venture capital behind them? What other services and features might they launch? How will they further monetize the power they’re rapidly accumulating? What will product designers do once they’re dependent on the platform and Faire ups the ante?

WHAT’S THE FUTURE OF FAIRE?

Full disclosure: I’m married to a whip-smart engineer who has spent decades immersed in the tech world as a product architect. We regularly chat about the societal impacts of technology over Sunday brunches. His career, wisdom, and perspective sometimes give me pause about the direction society is pursuing. Not the kind of pause that calls for accumulating stockpiles of canned beans or the installation of survival shelters. But the sort of pause that means I’m not voluntarily putting my DNA on file with 23 & Me or installing listening devices around my house (a la the Amazon Echo). So while my inherent skepticism isn’t anywhere near “911 was an inside job” levels, I’ll cop to a certain degree of pessimism and caution. And Faire raises red flags on several fronts.

Max Rhodes, Faire’s co-founder and CEO, has made no secret of his plans to expand their reach and rack up profits. I question the broader implications of reinventing the world of wholesale, courtesy of a single company that’s well-funded and decidedly ambitious. Even at the current scale, Faire tilts heavily in favor of buyers over brand owners. And I wonder how additional opportunities to monetize the platform will affect the artisan community. It’s important to ensure that we’re not crawling into bed with a hot new paramour who later turns out to be perpetually self-interested and motivated by different ideals. It’s of no long term benefit to be drawn deep into a relationship that eventually results in our co-dependence.

At the end of the day, Faire enjoys access to a startling amount of data about shopkeepers and brand owners. What products a store stocks, which products sell and at what rate (thanks to integrations with the shop’s POS system), what products from any one brand are returned and at what rate, how often a brand converts with shopkeepers, a brand’s pricing and policies, the density of any one brand in a given area, even which brands a shop previews on their platform. The nature of tech companies is that they trade in data, and I question what protections are in place for that data (the Faire privacy policy is decidedly vague). I wonder if the data gathering is even more valuable than the commissions collecting. And since Faire’s founding team originally met during their time at another tech company (Square), surely they realize the potential monetization and application of all that data.

I have additional reservations about working with Faire (specifically around their return policy, data collection, and the potential for brand dilution) and I highlight those in the next blog in this series. I invite you to read my additional thoughts about the pros and cons of Faire.

DO YOU HAVE EXPERIENCE WITH THE FAIRE WHOLESALE MARKETPLACE?

This blog is the fourth in a series about Indigo Fair/ Faire. As this series continues, I’ll explore:

• What is Faire?

• How to sell on Faire.

• What Makers & Buyers Love About Faire.

• An interview with Faire executives. They’ll share some of their future plans while addressing a few of my concerns about the platform.

• How makers in the Lucky Break community feels about their experiences with Faire, plus the hard data about how much and how often they’re selling.

What are your concerns about Faire? I’d love to hear your experience with the platform. Please drop a comment below!

1: Here’s a BIG LEGAL RED FLAG: If Faire doesn’t allow a brand to see/have access to a retail buyers tax ID number, Faire is violating several States laws regarding wholesale/retail sales. Even more so if the buyer is located in the same state as the brand. My state requires this info. It’s not negotiable. And if the brand has an audit from their state, guess who bends over and gets the $hit end of that stick? Even worse, if there’s an audit from the IRS, the brand once again, will get the $hit end of that stick. Who in their right mind wants to have to worry about that? Or jump through who knows how many hoops or even have to get their lawyer involved to get this very basic info.

2: If Faire doesn’t have or maintain a set “Buy Back” option (and terms that don’t change every. other. week), brands should expect to one day roll into their local discount/dollar/off market store and see their products there. If this isn’t specifically set out and adhered to, Faire can have the right to dispose of product/merchandise in their possession in any manner that they see fit. My lawyer told me from day one of me going into wholesale to add a buyback clause to cover many potential adverse events that could happen to a retailer, up to and including Force Majeure. Some might think that’s overkill, but hey, guess what happens when -not if- that happens? More bending over.

Both of these are something all brands should think about.

I received an email this morning and wanted to include Belinda’s thoughts in this discussion….

“Hi Lela

I am trying to comment on your blog to one of the blog posts on the Faire series, but unable to – I get an error message. Here is what I am trying to write.

Thank you for putting together these great blog posts on Faire. We have been approached by Faire and have an onboarding call with them tomorrow. I have 2 concerns. The first has already been addressed (and commented about) and is in regard to not knowing who the Faire customer is. If we get labels, surely we would have an address? Also, the issue of Tax ID has been raised – I look forward to your further comments on this.

Here is my second concern – our product is a rain poncho. It seems to be the only (and probably first) apparel item that is on the Faire site and I do not think Faire have had any prior experience with dealing with apparel – which is its own beast. Our ponchos fold up into a small packet (we call it a pouch). When the ponchos exit the factory they are neatly folded into this “pouch” – and I mean very neatly. While it is certainly possible to refold the poncho back, we always hold any returns aside for marketing use as they are not deemed neat enough for resale. So if a store has a return policy for its customers, and the customer decided to return the poncho – what is stopping the retailer to return this within the 60 days glory period? Regardless, I do not think we will get any returns of the poncho in the same state that they were sent out. This is my red flag.

Do we know how many of the retailers using Faire are brick and mortar and how many are online? My product is better suited to online. It would be nice to specify online only. This platform already seems to be favoring the retailer over the manufacturer.

Kind regards

Belinda”

hi there

as Belinda noted we are shipping to customers therefore we know who’s buying , no?

also as far as sales tax, exemptions, audits etc etc it appears Faire is the one paying . no? then the 1099 or what ever tax form is required will come from them

not a wholesaler yet with Faire. but do have a call tomorrow . turned away from them in the past because of fees. however in the food industry most distributors get 30-35% plus guarantees and buy backs. we always get it in the $hit and of the the stick from them. lots of dishonesty because they feel their margins is too small at 30-35%. funny wish we had those margins without all the OH to get there

Pingback: Fresh Funds Brighten Faire Marketplace

Pingback: Fresh Funds Brighten Faire Marketplace | E-Commerce – Buying Soon

Pingback: Why wholesale Marketplaces will be the end of your brand and business - TURIS

Pingback: En online markedsplads kan blive enden på dit brand - TURIS

Faire has a ton of fraud going on. They will charge cards without authorization, change the name of the meRchant account and more. They are being looked at by the SEC and there have already been arrests. BUYERS BEWARE! I lost over$4,000!b This is. Not a company you want to do business with, in fact, companies are leaving faire in droves.

Hi Martha. I tried to do an online search of this and find information, but I can not. Do you have any articles to back this up? I would like to learn more.

Do you have anything to back this up? Seems like either you’re a competitor and made this up or you didn’t know anything about Faire. Apparently, we can’t find any info about this. 🙂

Pingback: Fresh Funds Brighten Faire Marketplace - E-Commerce Times

I do not need a sales permit in Oklahoma being that I sell on legitimate Market Places and its under 100,000. I don’t sell in more than 5 states. Since 2019 the law says if thats the case its the burden of the Market Places to handle paying the taxes since they collect it. So I can’t purchase though without it. What a catch there. I have nothing to report or pay but I cannot purchase. So frustrating. Laws and business need to catch up with the time. Faire though has my info in there computer bank. So at least they got my info and I got NOTHING!

I’m on the same boat. Except I have a resale license and they still denied my account

That’s what the did to me!

I am in the UK and I have lost $000’s they take 25% they dont do anything when it goes wrong and they UPS who have taken over a month to send goods to Denmark, and they were returned as they never paid the customs fees on time, they goods are another months in transit and I am expected to cover the loss when the goods are nowhere to be found this is the 3rd time this has happened. They do sweet FA when you ask them to get invovled with UPS, they are the UPS customer not me !!! our wholesale prices are high so no one buys from us as i am not suffering the losses. The buyers are not aware of the commissions they are taking they are just wrong wrong and wrong…we have our own wholesale site and now found a company in the USA who will do all our logistics end to end B2B and B2C and help us scale and they charge a fixed fee per order…happy days sell direct and know your customer not Faires customers mine all mine so two fingers up to them

My wife was approached by an existing buyer, asking her to join Faire. Faire’s first request says a great deal about the enterprise, which was that they wanted all of her wholesale contacts up front. This tells me it’s at least as much a data aggregator as a wholesale agent. You spend years building a wholesale business and they want all of that for free so they can plug their other sellers to your clientele? Nope.

I am disgusted with this platform. I am now with faire for about 6 months and getting a lot of traffic and sales. Suddenly they suspended my shop with no explanation. I reached out to them for help because I have put so much effort on that shop. But the cs just responded to me that they maintain a safe platform for retailers and wholesalers thats why they can no longer allow my shop to sell. But I asked why and what are the reasons my shop got suspended and to my surprise the CS said that she cannot discuss the reason of my deactivation. Faire unfortunately act so unfair to us wholesalers! They have earned so much from my shop but I get this kind of treatment. I am wanting to make an appeal and go further with this! I felt scammed by this platform!

The same thing just happened to me. I had a 4.8 rating from customers and many repeat buyers and then out of no where I was told that I had breached the terms of agreement and they had shut down my shop and cancelled all pending orders. I cannot get an answer to what condition I breached. I have tried several times (with different customer service individuals) to understand what I did but the only answer I get is that I should “refer to the terms of conditions”. I have read through them and I do not know what I did wrong. I feel very wronged by a site that I generated commissions for and feel that they at least owe me an answer as to what I did wrong. It is a bad way to treat their brands. Has anyone else had a similar situation?

Same thing just happened to me. Still trying to see what I supposedly violated. I have a 5 star rating! No complaints. This is crazy!

Sadly it’s not a very balanced setup, and the retailers have the most power in this ‘Faire’ structure. A retailer claimed a postage box was damaged during postage but refused to send me pictures of the ‘damaged goods’ within it, as a whole (just the packaging). So I couldn’t claim the insurance on the damage and the retailer had the right to set the cost of the product.

I sell hats that take at least 3 hours to make by hand (on a good day) and got £15 for a product that retails full price at £240.

Wholesalers beware.

As a buyer (jewelry and womens apparel) I created a ‘wholesale buyers’ account to see what would happen.. I did not have to submit any kind of resellers permit or tax ID, and the website I entered was fictitious. Faire.com accepted my information and allowed me to enter the website as a wholesale buyer. Something is amiss.

It’s a very dangerous site for growing brands with no working capital, and high manufacturing costs. Be very careful with this platform and remember to always have a plan B so you are not reliant on Faire.

I made an order with them and the had me tax# , resell number , then they ask ask received my Certificate of occupancy, copying my lease agreement, pictures of inside and outside of my business, and still asked for a DBA , more pictures and held up my order , I am not sure what they are up too. It’s still in process,

I’m interested in your use of the term “maker” in your article- do you use that as a term like the brands are making their products?

My experience as someone who designs and handmakes my products: I was contacted by a Faire rep and was led to believe that the other brands who are selling on the site were smaller makers such as myself. I proceeded with a video interview, in which the first question I asked was if the other brands on the site were resellers or if they also design and make/manufacture their products. Small makers such as myself can’t compete in prices or speed with resellers who buy their products on Alibaba. The Faire CSA assured me that resellers were not allowed on the site and they their sellers are vetted to make sure they aren’t reselling. She also explained that there are filter options such as “not on Amazon” etc that could be used to filter search results to steer buyers toward brands like mine.

However, when I joined Faire, a mistake was made during my on-boarding where they assigned my email as a buyer not a seller, and as a result I get the same emails that buyers receive. And I can tell you some of the products I see are just resellers who are claiming to be the makers or designers, and saying their products aren’t available on Amazon. I contacted Faire about this observation, and they actually asked *me* to do the vetting and show them the evidence I had found that the items on *their* site had been purchased in bulk on Alibaba. I’m at a loss to understand why that work is my responsibility when I pay such steep commissions to them.

Now that you’ve explained that they need to increase their income, it doesn’t surprise me that they’re taking any brand that has a pulse. But it’s going the same direction that etsy went which is terribly discouraging – lots of resellers selling things from Alibaba and DHGate. There are fewer and fewer places that can truly say that they are platforms for small makers/manufacturers.

I have happened across this article and comment thread and it is quite fascinating!! I am a sales representative for several well known toy brands many of whom are on Faire (quite frustrating because Faire was originally designed for Makers and Artisans). As was mentioned, sales representatives do cost a commission, but please let me tell you what you get for that commission and please let me know if you think it has value!

1. We support each and every manufacturer we represent, not only in sales but in product development, packaging design help, cleaning up account lists, and even collections.

2. We are ALWAYS ASKING about our products, meaning we aren’t waiting for a customer to click on a link or read an email to get noticed…we are in stores, merchandising, straightening shelves, teaching about our products and making sure they are stocked with what works for them!! Keeping brand alliance and uniformity so end users understand the brand quality!

3. I offer a buy back! If a customer is on the fence about a product or line I represent, I offer to buy back what doesn’t sell…any time, no questions asked. Many sales reps offer this, we have a huge network of customers and if something doesn’t work for one, we know where it does work!

4. Many of us now offer online ordering portals, so you can order when you have time! But we are still very happy to meet with you with samples, catalogs and information to help you buy the best selection of products for your store, not because we are trying to get a higher commission but because we want YOU to be successful selling our lines!

5. We help…no matter what! We help the customer, we help the manufacturer and most of us answer pretty quickly, seven days a week!

6. We are your neighbor and/or customer! WE SHOP IN YOUR STORE! (if you have one!!)