Hi! Lela here. I recently passed my blog microphone to Shannon, Lucky Break’s Creative Director- and she generously gave you a peek behind her Hettie Joan brand launch. This week, I’m passing the mic to Melissa, Lucky Break’s Operations Manager a.k.a. “My Right Hand.” She’s a brilliant project manager and ball juggler here at Lucky Break, but she also has a pretty amazing stationery company as well. I invite you to discover Print Therapy and then read on to learn how Melissa recently crowdfunded a $7,000 loan through Kiva to help her launch a new product collection.

I’m a big Kiva fan… after all, who else invites entrepreneurs to borrow up to $10,000 to grow their business at ZERO interest, with ZERO fees, and without having your personal credit attached to the transaction? Kiva a reputable non-profit with a long track record of facilitating microloans to entrepreneurs around the world. And Melissa’s going to pull back the curtain and show you how it’s done. Take it away, M!

If there’s anything I’ve learned from being a part of the Lucky Break team, it’s that I’m not alone when it comes to my dreams being bigger than my wallet. The idea of starting a business can be intoxicating, but when you learn the dollar signs associated with that dream? That can be pretty darn sobering.

I spent the first three years of my business sort of floundering, trying new things, learning what worked, and learning what didn’t. Once I honed in on my niche (thanks, Brick House Branding!), and after a few brainstorming session (thanks, Lela!), I had a handful of ideas I knew I wanted to bring to market. The one thing I didn’t have? The money.

Although I had heard of Kiva before – in fact we lend through them as a part of Luck Break’s philanthropy efforts – I had never thought about attempting to raise a loan through them for my business. I mean who wants to fundraise? Who wants to raise money? Who wants to ask the people they know for help? I’ll tell you who. This business owner. And maybe you, too.

During one of my consultations with Lela, as we were discussing products and the financial state of my business (spoiler alert: I was out of money), she mentioned casually that she thought I could get a Kiva loan funded with relative ease. I’m not sure why, but I shrugged it off. I’m not the best at admitting that I need other people to help me, and asking people for money always feels a bit weird. But once I hung up the phone after our consultation, and the dreaming phase was over, and the get-to-work phase began, I realized that I needed to find money somewhere, and I needed to find a good amount of it, fast.

I’d like to tell you that I did my due diligence, studied Kiva and their stats, and took a few days to make my decision. In reality, I did a quick review of the site to understand their terms … and had my application started not even five minutes later. And about twenty-five days later, the money was comfortably in my account, ready to make those dreams a reality. Curious to know how it happened?

THE APPLICATION

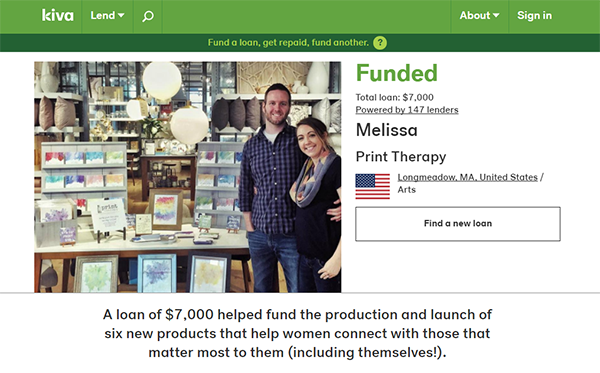

1. The Application process was pretty straightforward, but it included creating everything you see on my lender page. My story and my dream were just as important- if not more important- as statistical information about my business. Also important? A great photo that shows the people – and the heart – behind the business. The application is also where I indicated the amount I wanted to raise, and the number of months I wanted for my repayment terms.

Hint: You’re only allowed to have one Kiva loan active at a time, which means you cannot initiate a second loan while you’re repaying your first. Think wisely about how much money you’ll need – and don’t let fear talk you into a smaller number. First-time Kiva borrowers can tap up to $10,000.

2. About 24 hours later, I had a call scheduled with Kiva, and my application was approved (HOORAY!) on the call. We also discussed repayment terms, and, most importantly, what it would take to make my loan public. As it turns out, once you’re approved, your loan page doesn’t just go live on the Kiva site, for any and everyone to throw money at you.

3. My Kiva rep, Richard, informed me that I needed to have at least 22 people I’m personally connected to lend me $25 each within the first fifteen days in order for my loan to go public, and for any Kiva lender to be able to find it and lend to me. It’s important to Kiva to see that you’re committed to your own success and that the people who know you believe in you, too. If I didn’t hit that magical number of 22? My loan would effectively be canceled, never to see the light of day.

THE FUNDRAISING

1. As soon as my Kiva page was live, I wasted no time sharing it on social media – both through my business pages and through my personal page. I knew that I had 15 days to get 22 people to lend me their hard earned money, along with their belief and support. I shared daily on both Facebook and Instagram.

2. I then proceeded to stalk my lender page, and I’m pretty sure I wore out my mouse with all of the incessant refreshing. I was on pins and needles, nervous that I wouldn’t find 22 people who believed enough in me to lend me $25. In those moments, my lack of money was only matched by my lack of confidence. I. Was. Nervous.

3. As it turns out, people like to give their money to things and people they believe in. I had 50 people within my network – friends, family, old high school and college classmates, former co-workers – lend to me in the first two days, bringing in over 30% of the money I had to raise. I was on my way! My loan was now public on the Kiva page, available for all Kiva lenders to see.

4. 30% was great, but I knew the momentum would begin to slow down if I didn’t keep fanning the flame. I posted. I blogged. I newslettered. I posted again. I blogged again. I newslettered again. I talked about how the money would support my business. I talked about how the business would support my family. And I talked about how much their support would support me.

I harped on the fact that this was not a donation; my business dreams were not a charity case. I had every intention of paying every cent back. And the people who had already lent to me? I was able to send notes to them, letting them know how things were going, and sharing my gratitude with them. Every day I tracked how much money had come in, and what I had left to be fully funded. It was a great reminder to keep on talking.

![]()

5. On Day 20, I received a loan from “Tom”. It was my biggest loan by far, at $900. And it took me all the way to 100% of my goal. I had no idea who this Tom was until I received an email a day later from this mystery Tom, and his wife, Heidi. They were my high school classmates that I hadn’t talked to in 15 years, but they had been following along with my business on social media, waiting for the right moment to jump in to help. They found their moment. And it gave me my moment. I was funded.

6. In the end, 147 people lent their money to my campaign, most lending $25. I know less than half of them. I’m grateful for all of them (especially those of you who are reading this blog). That’s 147 people who said, through their wallets, “you can do this. I believe in you.” We all know money talks, but in this case, it really did.

THE FUNDING

1. Kiva is an all or nothing lender; if you don’t reach your goal 100%, you don’t receive any of the money. And when you reach your goal? You get every single penny. There is no fee associated with the distribution.

2. The money is distributed via PayPal, and it’s pretty instantaneous. One day the money isn’t there, and a few days after you’re fully funded… there it is!

3. This is a 0% interest loan, so what you borrow, you pay back. No more.

4. Kiva prefers an automatic repayment setup, where they withdraw the monthly repayment from your bank account each month. At each repayment, each lender gets a percentage of their loan paid back to them – usually a few dollars each month, depending on how much they loaned. Hint: When I was determining how much money I wanted to apply for, I built-in a cushion for a few additional months. I knew that it’d be hard to start making repayments while I was getting my new products ready to sell, so I allocated a portion of my funding to, well, re-funding my lenders.

5. After the funding is completed, it’s recommended that you continue to update your lenders with your progress, to let them know how you’re putting their dollars to work. Sure, they care about their money, but many of them care more about your success.

The beauty of the Kiva process is that you’re not getting approved by some guy at a bank who deems your credit or business savviness is worth investing in. You’re getting approved by normal, every day people who deem your dream, and your story, worthy. They deem you worthy. They believe in what you believe in, and what you’re trying to do.

So you believe in you, too. Put yourself out there. Tell everyone and anyone why you, and your dream, and your story, are worthy. And get that money, honey.

Hi, Lela again. *wink* How much do we love Melissa, eh? I’d love to hear about your Kiva experience… please pop a comment below and let me know if you’ve given Kiva a try- either as a borrower or a lender. And if you’ve discovered other creative ways to fund your business, then I’m “all ears” to hear about those, too!