Lately, my LBU students have been deep diving into some important costing exercises, because the first rule of wholesale is that you can’t afford NOT to know your COGS (cost of goods sold). And this isn’t the sort of thing that you can guess or estimate. This is the very left-brained component of our typically right-brained businesses and while number-crunching doesn’t have to top our “Favorite Business Tasks” list, it should have an honored placed on our semiannual “To Do” list.

I’m so passionate about the need to crunch accurate numbers often that l even included a Product Pricing Worksheet and a Pricing Calculator Tool (think of it as a lighter version of Price-O-Matic) for each of the LBU crew. I wanted to share with you two piece s of the pricing puzzle that I often see forgotten in overall calculations. But first, a quick lesson in COGS…

COGS ARE THE EXPENSES YOU INCUR WHEN CREATING A PRODUCT AND BRINGING IT TO MARKET

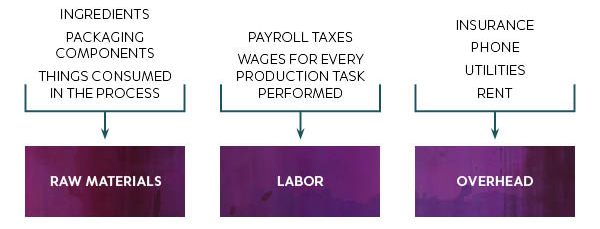

In their most basic form, the costs of good sold (COGS) are the combined expenses involved in bringing a product to market. For most creative entrepreneurs, those costs include…

• Raw Materials: The tangible components that compose your final product, plus product packaging

• Labor Costs: What it costs to pay someone to make that product

• Overhead Expenses: Workspace rent, utilities, insurance, phone and internet systems, etc.

Raw Materials + Labor Expenses + Overhead Expenses = Cost Of Goods Sold

While pricing strategies are a dime a dozen, virtually all of them involve COGS as their core element. Simply put: you can’t attach a price to something unless you know precisely how much that something costs you to make. There are two small but important pieces to this COGS puzzle that I see left out time and time again:

a) Transportation costs for raw materials

b) Mandatory payroll taxes

Let’s look first at the transportation costs for raw materials.

In my LBU program, we’ve been running an imagined t-shirt company (aptly named: “The Best Damn T-Shirt Company In Town”) which produces screen printed tee’s. These might be our raw material costs for a single t-shirt.

T-shirt: $4.20

Ink: $.52

Custom neck label: $.14

Hangtag: $.10

Which brings our raw material costs to $4.96 per shirt. But wait! Did we pay to have any of those raw materials shipped to us? If so, then we’ve likely also paid freight costs. The ultimate goal is to understand the “landed costs” of each raw material, which reflect the the cost of the raw materials after it’s landed on your doorstep.

There are several approaches…

1. Add a flat percentage.

Typically between 5-20% depending on how heavy your materials are and how far they’ve traveled. Using this system, our $4.98 is now $5.23-5.97. This is the easiest method if you order multiple items from a single vendor or purchase a single item from multiple vendors.

2. Calculate actual shipping costs per unit.

If you purchase 100 shirts at a time and the shipping charges on those 100 t-shirts total $18, then the shipping cost per unit is $.18. Our $4.20 t-shirt cost is now $4.38. This method takes a bit more footwork, but it’s obviously the most accurate, too.

If you fail to add in all those transportation costs, then you ultimately shortchange your raw material calculations. Make certain that every raw material cost in your COGS calculations represent landed costs.

The second missing piece involves the employer’s portion of payroll taxes.

Every type of pricing strategy relies heavily upon accurate labor costs, yet this particular expense bucket is often one of the most challenging for an entrepreneur. Determining correct labor costs is dependent on four factors:

1. Including every step + type of labor involved.

2. Accurately calculating how long each of those tasks takes per item produced.

3. Properly valuing the labor for each task.

4. Remembering to calculate required payroll taxes.

Oh yes, the dreaded payroll taxes. I’ll never forget the day I got my first paycheck (as a mail clerk in an insurance office at the age of 14) and how I stood there stunned, with a subtly trembling lip, as the realization washed over me: the federal government was going to dip into every paycheck for the rest of my life. On the scale of horror, it was second only to the day that I cut a paycheck to my first employee and realized that as an employer, I’d be chipping in as well.

In fact, you’re responsible for matching your employee’s contributions to social security and Medicare. You’re also legally obligated to pay state unemployment taxes and federal unemployment. Icing on the cake: you’ll most likely be required to provide workman’s compensation coverage, though those laws vary by state.

What does that mean for you? When crunching labor-related numbers and planning for future growth, your $10 per hour job is going to cost the company around $12 an hour. Running the numbers without including all those additional costs is a recipe for disaster. I recommend reading this article for more details and then contacting your state’s Department of Revenue to ask about specific state rates. If you’re the type that likes to boil things down to essence, you can add a blanket 15-20% onto your labor calculations to accommodate for payroll tax expenses and workman’s compensation.

One more thing: Please remember to pay yourself. Too often, solopreneurs neglect to precisely calculate labor costs, if they calculate them at all (after all, we’re the primary source of labor, right?). If you have any ambition to scale your business, then you m.u.s.t. factor labor into your equation from the very beginning. Neglecting this important exercise means that you’ll either lose your ass when the time comes to hire employees, or you’ll be forced to raise prices suddenly and significantly.

Besides, your time has value and there’s a powerful mindset shift that begins to take shape the moment you start valuing your labor appropriately.

Valuable information. Fortunate me I discovered your website by chance, and I’m shocked why this twist of fate did not took place earlier! I bookmarked it.